Taxes can seem like one of the most challenging parts of business ownership. You’ll need to pay specific taxes, cover your obligations to any employees, stick to a schedule, and learn to navigate write-offs and industry-specific expenses.

Figuring out taxes is almost a part-time job — at least, during the months leading up to April. Fortunately, it doesn’t have to be such a headache. Check out these tips from

Allendale Charter Township to start feeling more confident about your tax situation.

Add Tax Filing and Other Dates to Your Calendar

Knowing what to expect when filing taxes is your first step in simplifying the process. The same way that you file personal taxes, you’ll also file business taxes come April. But as a company owner, you’ll need to provide your workers with paperwork, file your own copies,

and pay any taxes you owe.

Filing taxes on time is essential to avoid underpayment penalties and other complications. Keep track of

important dates for both your business filing and providing the IRS with your staff’s forms.

Know 1099 Dates and Rules

The general rule is that businesses must send their 1099 paperwork to contractors by

January 31st. However, only contractors who have completed $600 or more of work for your organization require this step.

It’s also worth noting that there are two types of 1099s. A 1099-NEC is the newest form the IRS requires for non-employee compensation, and it’s due on January 31st. The 1099-MISC form covers different payment types, such as rent, attorney fees, and other specific expenses paid to contractors. Also, note that 1099-K is another form you may need — this applies to payments made via credit card, payment card, or other specific billing scenarios.

Fortunately, with the right payroll software, you have the option to

file 1099s online, which streamlines the paperwork process (three steps, and you’re done!) and can save you time, too. Once you file online, digital copies will be automatically generated and sent to the IRS as well as to your contractors, which amounts to even more time saved.

1096 Rules

After providing the contractor with the appropriate 1099, you’re responsible for filing 1096 to the IRS. The 1096 form is your version of the 1099 — it summarizes the 1099 amounts of all your payments to contractors.

Prep Paperwork Before You Need It

Regardless of the type of staff you hire, you’ll need to file tax paperwork for them each year. The easiest way to keep up with your paperwork is to collect the appropriate forms from every new hire, no matter how short your project will be. That way, when tax time comes, you have your forms ready.

- When you’re hiring employees, whether part-time or full-time, you’ll need a W-4 form from them.

- If you’re onboarding contractors, freelancers, or other project-based workers, they need to fill out a W-9 form.

Before tax-time arrives, reach out to your team to ensure everyone’s information is correct before submitting your paperwork. Add this to your tax calendar, too!

Pay More Rather Than Less

As a business owner, you’ll likely be responsible for paying estimated taxes throughout the year, notes USA.gov.

Estimated taxes are calculated based on your business’s quarterly income, and they’re also due quarterly.

Your best bet is to calculate your estimated taxes and pay that amount or more throughout the year on the appropriate dates. That way, you avoid

potential underpayment penalties. But in addition to the payments

due, you may also qualify for special tax breaks — a notable perk of business ownership.

Don’t Fear the IRS

Though taxes can be tough to navigate, there’s no reason to fear the IRS. Even if you’re unable to pay taxes you owe, or you discover you’ve

made a mistake on your forms, there is always a way to fix the mistake.

That said, it’s worth the effort to take your time navigating taxes — or hiring a professional to help. Once you are more confident in handling tax forms and details, next year’s tax season will be even easier.

Business ownership involves many challenges, but taxes don’t have to be one of them. By preparing ahead of time and keeping to a schedule, you can stop stressing and focus on your work instead.

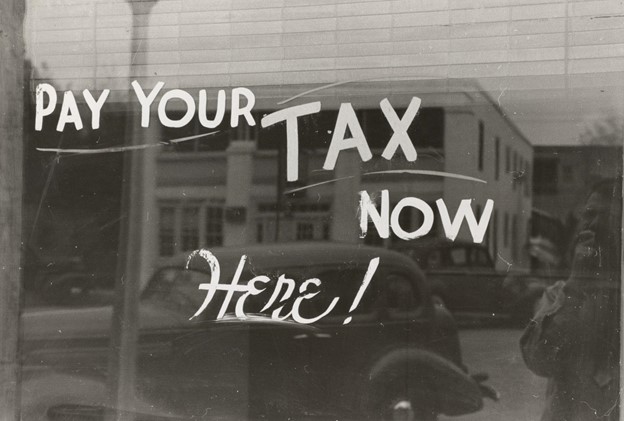

Photo via Unsplash

-slider.png)

-smaller.png)